Standard form of Caveat - prevents registration.ĭoes not prevent registration of a lease by a mortgagee or chargee in possession. Not required where the registered proprietor (lessor) is the Land Administration Ministerial Corporation.

any alteration to the reference to title or premises description, or increase of the term or annual rent must be marked.in the case of a lease in respect of which a lump sum is to be paid, whether 'rent' or 'premium', regardless of the date.Once your tenant has established a payment history using a more secure method, you may decide to accept personal checks since they have built up the trust level. Personal Check- With personal checks, there is no way to verify if the check is real or if the funds are available until you try to deposit the check and it does not actually clear.While most people are honest and would not commit this type of crime, it is not worth the risk. If they are able to put money into the account using this information, they are also able to take money out of the account using this information. Direct Deposit Into Your Banking Account- Do not allow tenants to directly deposit their monthly rent into your banking account because this involves you having to give them your account number and your routing number.Secondly, the tenant always has the opportunity to report this charge to their credit card company as fraudulent, leaving you with no payment until the situation is rectified, hopefully in your favor. First, you will usually have to pay some sort of a transaction fee to the credit card company. Credit Cards- Do not allow your tenants to pay rent using a credit card.she said dispute with no way to prove how much cash was actually in the envelope.

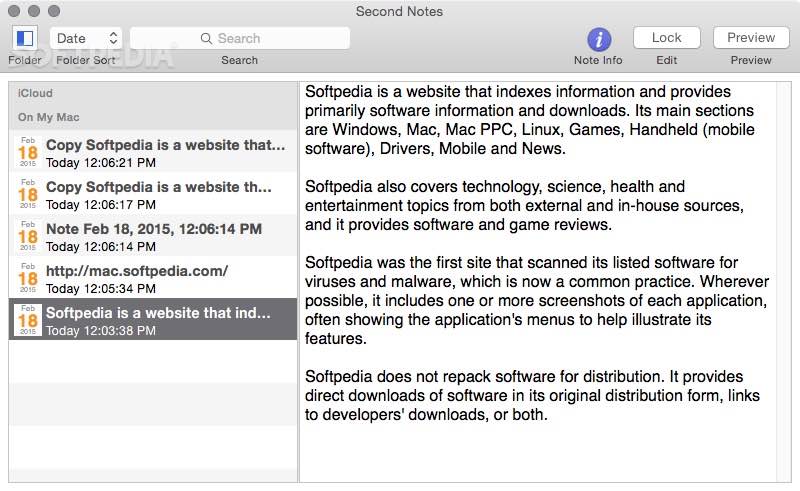

#Second notes for rent full#

If the full rental amount is not in the envelope, it will be a he said vs. The tenant can claim they have given you the full rent amount in cash, but you may realize they are $20 dollars short when you actually count the money. Cash- Do not allow your tenants to pay their rent in cash as it is difficult to document and easy to dispute.P2P online payments platforms, like Venmo or Zelle, are also smart choices as they allow you to pay your landlord by using their email or phone number. There are many online rental payment sites such as ERentPayment, RentPayment's RentMatic application, and RentMerchant. It is quick, the funds usually transfer immediately or within a day or two, and it requires little effort. Online- Online payments that do not require you to provide any of your personal banking information to a tenant are a good option.The post office then gives the tenant the money order for $1000, which they give to you.

For example, the tenant wants a money order for $1000, so they give the post office $1000 in cash. The tenant had to transfer funds in order to get the money order, so it is like receiving a gift card of rent.

However, there is a larger fee associated with a cashier’s check and they are only issued by a bank where the tenant has an account.

0 kommentar(er)

0 kommentar(er)